Aboutme.SubinFinance - Financial Bubble Burst in China

Aboutme.Finance

Aboutme.SubinFinance

Introduction About World Finance Scenerio:

World News: What China's bursting stock bubble means for the US economy

When the western eyes firmly focused on Greece, on the other side, World’s Second biggest economy is zooming with financial crisis. Yet it means that Chinese market is facing the real crash of the history, where stocks crashed and economic catastrophe is looming high.

A mere 30% fall in Chinese Stock Market, compared to roughly the entire gross domestic product of UK’s economy last year after the stock has almost doubled in a year or so, made the front paper of every dailies in the world.

Economic Development – 1929 in United States of America and China today seems same.

Chinese News: China embraces the markets

Chinese Government is intervening to stem the panic,

by packing off 290 companies who mistreated the ongoing trading system. Now

this figure has escalated to over 940 companies, which the government had

suspended trading on two major indices. On the other side, Greece has been

recommended to not leave the EURO community.

China wealth development started from the Financial

Structural Program in 1980 which impedes growth and created more wealth than

any economy in the world. It’s yearly growth rates has passed more than 10% in

a decade, which is considered to be counted on any accounts. But all these

growth are just “CREATION OF CREDIT” which enhances growth. Once a stage is

reached, the bubble will burst and market will slope to the lowest level and

economy will be in tantrum. Foreign Direct Investment and Foreign Institutional

Investor played a huge part in the growth of Chinese economy.

Chinese Stock Market Bubble is just a one year wonder,

whereas Dow Jones Industrial Average crash is considered to be sustainable.

Over-valuing of stocks a couple of years ago, where the stocks will be

appreciated to such a level shows that stock value is considered to of fair

value.

In the final stage if you see the value of stocks which

has grown by more than 50% and considered to be “ESCAPE AND BELIEVE IT” policy.

The same thing happened in the Chinese market where this time last year all the

stocks has appreciated to more than 50% . Now the scenario is dazzling as the

value of stocks has been compared to Over-Valued stock s of United States of

America. Apart from that Real Estate boom which created the speculation has

marred the market of Chinese Economy. Banking Stocks, infrastructure stocks has

boomed to such a level that valuation is considered to be imaginary, due to

speculation in real estate.

Drawback Of Both Economies Compared:

The main drawback happened in both United States and

China market is that migration of rural workers to cities to feel the

prosperity of Industrial sector. Same thing happened before 1929, as migration

increased to cities as topsy-turvy companies like Automobile, Steel Industries,

New Technologies and Consumer Durables created immense profit started

attracting people. Same thing happened in China as production increased to

historical level which creates a glut in global demand. Now the Chinese

Government is trying to adjust this increased produce in the domestic market,

but reality is what is happening right now?

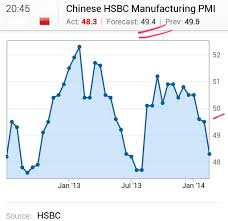

From January 2015, a slowdown note or signal has been

there as commodity prices has come down and global trade growth is snakelling

[Moving like a Snake] forward. Still the Chinese Government is trying to keep

the momentum growing by investing more cash into the system, which started

reversing and will fall to such a level they can even imagine.

VIDEO: therealnews.com/t2/index.php?option..

Economics is considered to be very pessimistic; More

Growth means the fall will be even more worrying. Chinese Government is having

a planned and Centrally Controlled Economy, which was running above the

economic theories. Now the consensus is clear that Shanghai Composite has

crashed to almost two-third value. Yet they’re coming up with fiscal and

monetary measures, and have the economy under control. As we see all the crisis

looms around the globe, stock market in all the countries will be having a bad

time and even worst than 2007-2012 recession period.

Escape Route Every Government Takes:

Chinese Government must print more money and keep the

system flowing as private money had already exited. They have excluded about

1000 companies which did the speculation, but believe it or not speculation of

market can’t be controlled by a Government itself. Chinese can’t have the Greenspan theory moving

along as they will be facing more constraints in the year to come.

In the 2007-2012 Gold has taken the mainstream of

investment, then housing sector will come into play, then when market is about

to burst every Government will be pumping in more money to cool off, which

boomed the stock market to an immense height. The corporate are thinking that

this bull market will be creating debt shifting to equities, which can increase

the value of their stocks. But actually debt market will be increasing to first

25% of GDP, which if not controlled will be booming to 175% of GDP like Greece

now.

Actually Stock Market valuation must not be the

criteria of Economic Growth; it must be shifted to HDI index and Happiness

Index. Banking sector will be the first to face the wrath of depressing

economy. China must study from Indian Economy, where they work more on

pessimism than on optimism. Banking sector is fully controlled by Reserve Bank

of India and I think it’s doing a wonderful job till now. Credit creation is

controlled and no flushing of funds in the market.

Comments